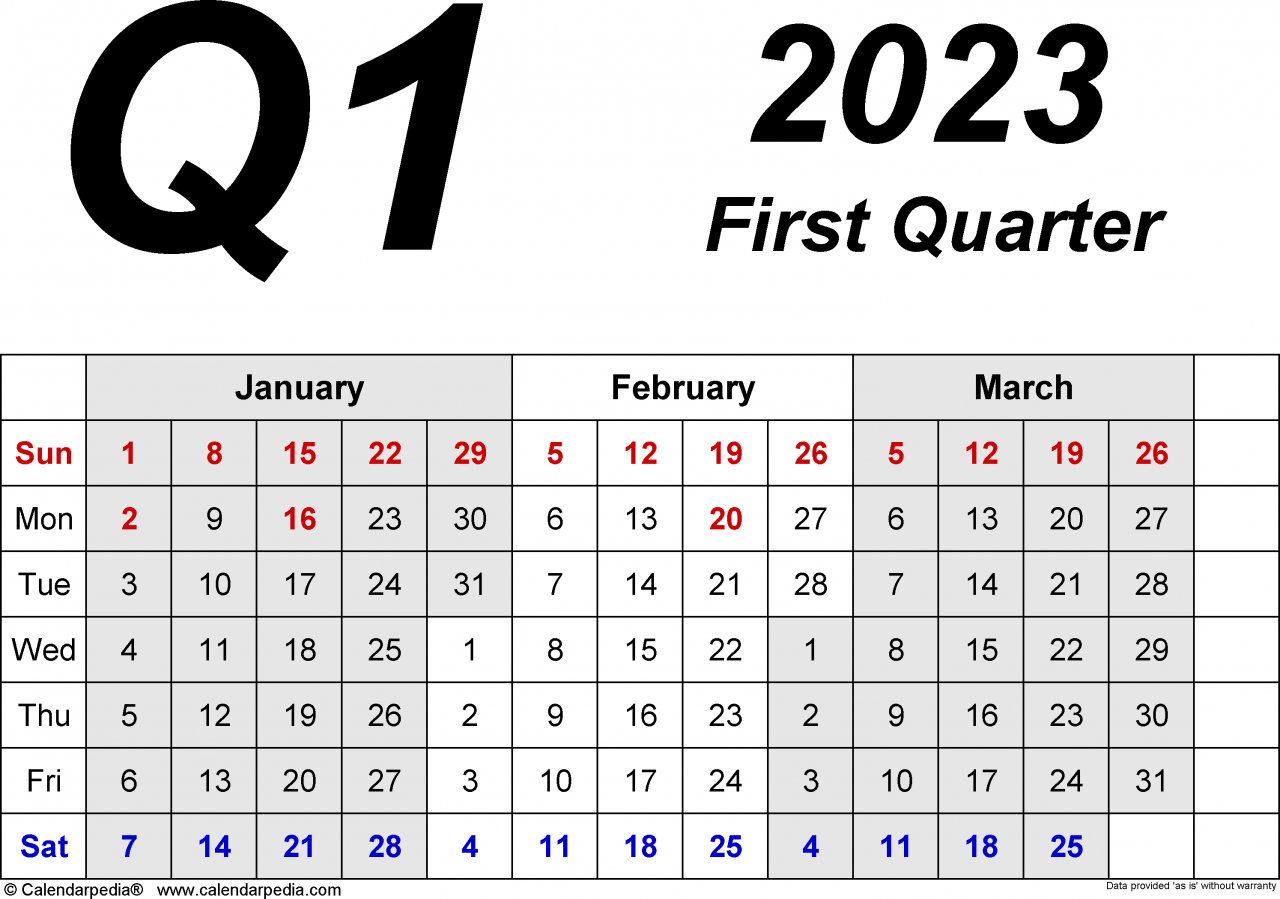

Of the 17 million individual income tax returns for the 2022 tax year filed with the Canada Revenue Agency (CRA) by the middle of April 2023, no two were identical.

Newsletter - Page 14 of 34 - Akler Browning LLP

The fact that Canadian households and families have been living with a significant amount of financial stress for the past year or so isn’t really news.

The vast majority of Canadians view completing and filing their annual tax return as an unwelcome chore, and generally breathe a sigh of relief when it’s done for another year.

There are a number of income sources available to Canadians in retirement.

Fortunately for the Canadian taxpayer, most individual income tax returns filed result in the payment of a tax refund to the tax filer. Notwithstanding, a significant number of taxpayers find, on completing the annual tax return, that money is owed to the Canada Revenue Agency.

Most Canadians live their lives with only very infrequent contact with the tax authorities and are generally happy to keep it that way.

It is an axiom of tax planning that the best year-end tax planning begins on January 1.

Two quarterly newsletters have been added—one dealing with personal issues, and one dealing with corporate issues.

Most Canadians deal with our tax system only once a year, when it’s time to complete and file the annual tax return.

For many years, the Canada Revenue Agency (CRA) has been encouraging Canadian taxpayers to file their returns online, through the CRA’s website. And that message has clearly been heard, as the most recent statistics show that just under 92% of returns filed in 2022 were filed using one or the other of the CRA’s web-based filing methods.