At a time when Canadian households are coping simultaneously with rising interest rates and an inflation rate which recently hit its highest point in nearly four decades, every dollar of income counts. And where that income can be obtained with minimal effort, and received tax-free, then it’s a win-win for the recipient.

Those qualities describe the basic child and family benefits paid by the federal government to eligible Canadians every month of the year. However, a substantial number of eligible recipients don’t receive benefits to which they are entitled simply because they haven’t claimed them, leaving potentially hundreds or thousands of dollars in tax-free income “on the table” each year. As well, many Canadians who do receive such benefits but who then fail to claim them annually can see their benefit payments stop, even though they remain eligible to receive those benefits.

While there are a number of such benefits, the process of “claiming” each of them is the same – simply filing a tax return each year. Eligibility for some (but not all) of the obtainable benefits and/or the amount of benefit obtainable is based, in part, on the income of the recipient. When each Canadian files a tax return, the Canada Revenue Agency determines, based on the information provided in the return, which benefits the taxpayer is entitled to, and in what amounts. Where the amount of a taxpayer’s income is relevant to the determination of eligibility, the income figure used is that from the previous year. In other words, a taxpayer’s eligibility for benefits in 2022 is based on his or her income for 2021. And that information was provided to the Canada Revenue Agency on the tax returns for 2021 which were filed by taxpayers in the spring of 2022.

Once the CRA receives the needed income information (usually by April 30, 2022) and the Agency determines a taxpayer’s benefit eligibility, those benefits are paid to eligible recipients throughout the 2022–23 benefit year, which starts on July 1, 2022 and ends on June 30, 2023.

It should be noted, as well, that while the federal government refers to these benefits under the umbrella term “child and family benefits”, it’s wrong to conclude that benefits are only available to parents and/or married individuals. Of the four benefit programs outlined below which will be in place during the upcoming benefit year, only the Canada Child Benefit program requires that a taxpayer be a parent, and none of the benefit programs require that a taxpayer be married or in a common-law relationship.

GST/HST Credit

The GST/HST credit is a non-taxable amount paid four times a year (on the 5th of July, October, January, and April) to low and middle-income individuals and families, to help offset the goods and services tax/harmonized sales tax (GST/HST) that they pay. Generally, the credit is available to Canadian residents who meet one of the following criteria:

- aged 19 yearsof age or older;

- have or had a spouse or common-law partner; or

- are or were a parent and live (or lived) with their child.

The amount of benefit which may be received is determined by both family size and income level. For the upcoming (July 2022 to June 2023) benefit year, the maximum annual GST/HST benefit is as follows:

- $467 if you are single;

- $612 if you are married or have a common-law partner; and

- $161 for each child under the age of 19.

The CRA website includes a chart showing the amount of GST/HST benefit which is provided at different income levels, to individuals and to families of different sizes and compositions. That chart can be found on the CRA website at https://www.canada.ca/en/revenue-agency/services/child-family-benefits/goods-services-tax-harmonized-sales-tax-gst-hst-credit/goods-services-tax-harmonised-sales-tax-credit-payments-chart.html.

Eligibility for the GST/HST credit for the 2022–23 benefit year is determined automatically by the CRA for each taxpayer who filed a return for 2021. There is, therefore, no need to indicate on the return that the taxpayer is applying for the GST/HST credit.

Climate Action Incentive Payment

Unlike the other three credits which are based, at least in part, on household income, the Climate Action Incentive Payment (CAIP) is a flat rate, non-taxable credit paid to residents of the provinces of Ontario, Manitoba, Alberta, and Saskatchewan. The purpose of the CAIP is to help offset the financial impact of the federal carbon tax.

In addition to living in one of the Alberta, Ontario, Manitoba, or Saskatchewan, recipients must also satisfy the same eligibility criteria as for the GST/HST credit, in that they must be Canadian residents who are at least 19 years of age, or have or had a spouse or common-law partner, or are or were a parent and lives or lived with their child.

Prior to this year, the CAIP was claimed on the individual income tax return and paid as part of the tax refund process. Beginning in 2022, however, the CAIP is paid in quarterly instalments on the 15th of April, July, October, and January. For the 2022–23 benefit year, the amount of CAIP receivable in each of the four provinces is as follows.

The Ontario program provides an annual credit of:

- $373 for an individual,

- $186 for a spouse or common-law partner,

- $93 per child under 19,

- $186 for the first child in a single-parent family.

The Manitoba program provides an annual credit of:

- $416 for an individual,

- $208 for a spouse or common-law partner,

- $104 per child under 19,

- $208 for the first child in a single-parent family.

The Saskatchewan program provides an annual credit of:

- $550 for an individual,

- $275 for a spouse or common-law partner,

- $138 per child under 19,

- $275 for the first child in a single-parent family.

The Alberta program provides an annual credit of:

- $539 for an individual,

- $270 for a spouse or common-law partner,

- $135 per child under 19,

- $270 for the first child in a single-parent family.

The CAIP (for all provinces) includes a rural supplement of 10% of the base amount for residents of small and rural communities. While there is no need to apply for the CAIP when filing a tax return, individuals who may be eligible for the rural supplement need to ensure that they complete and file a Schedule 14 when they file their return for 2021.

In 2022, because of the changeover to a quarterly benefit payment, the payment schedule for the CAIP is slightly altered. In July, eligible recipients will receive a “double up” payment equal to twice the usual quarterly benefit. The subsequent benefit payments (in October and January) will be single payments, each equal to one-quarter of the total annual CAIP. More information on the CAIP can be found on the CRA website at https://www.canada.ca/en/revenue-agency/services/child-family-benefits/cai-payment.html.

Canada Workers Benefit

The Canada Workers Benefit (CWB) is a refundable tax credit paid to lower income Canadian residents who are aged 19 or older or are married or have a common-law spouse or child with whom they live, and who have “working income” earned from employment or self-employment.

The amount of CWB which an individual or family can receive depends on marital status and net income. The basic amounts payable, and the net income levels at which eligibility is eroded, are as follows.

- $1,395 for single individuals

The single individual benefit is reduced if adjusted net income is more than $22,944. No basic amount is payable if the applicant’s adjusted net income is more than $32,244. - $2,403 for families

The family benefit amount is reduced if adjusted family net income is more than $26,177. No basic amount is payable where adjusted family net income is more than $42,197.

In order to apply for the CWB, a recipient must file a Schedule 6 with his or her tax return for the year. More detailed information on the CWB can be found at https://www.canada.ca/en/revenue-agency/services/child-family-benefits/canada-workers-benefit.html.

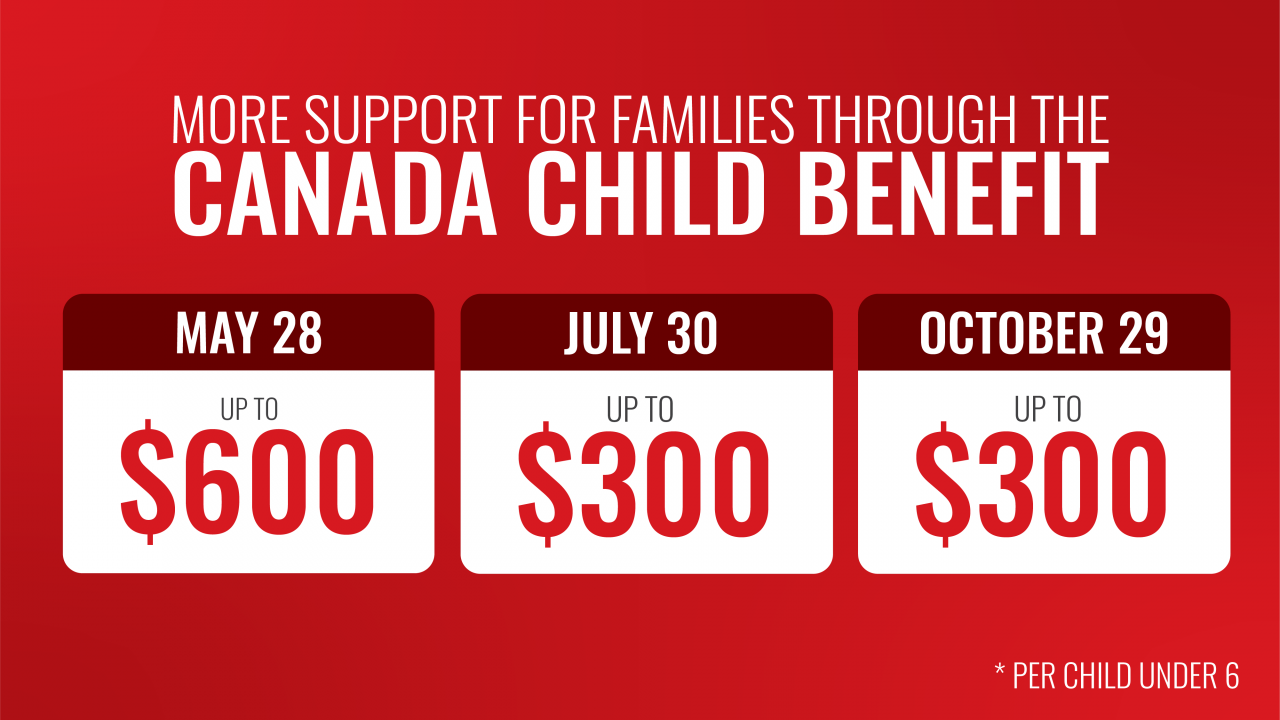

Canada Child Benefit

The Canada child benefit (CCB) is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The CCB is paid to the parent who is primarily responsible for the care and upbringing of the child or children, and the amount varies with the age and number or children.

The CCB is also a means-tested benefit, and the benefit amount which may be received is reduced as family net income increases. CCB amounts paid during the 2022–23 benefit year are based on family net income for 2021.

The maximum amounts payable for the benefit year running from July 2022 to June 2023 are as follows.

For each child:

- under 6 years of age: $6,997 per year ($583.08 per month)

- 6 to 17 years of age: $5,903 per year ($491.91 per month)

Where family net income for 2021 is less than $32,797, recipients will receive the maximum amount outlined above for 2022–23, with no reductions.

Individuals and families who may be eligible for the CCB will have their eligibility automatically assessed when filing a return for 2021: there is no requirement to file a particular schedule or other application. More information on the CTB is available on the federal government website at https://www.canada.ca/en/revenue-agency/services/child-family-benefits/canada-child-benefit-overview.html.

While the number and variety of federal child and family benefits, and the varying eligibility criteria for each, can be confusing, the necessary determinations and calculations are done by the federal government. The only step which need be taken by an individual is the filing of an annual tax return. Taxpayers who wish to find information on the benefits for which they may be eligible can refer to the Canada Revenue Agency website at https://www.canada.ca/en/revenue-agency/services/child-family-benefits.html, where detailed information on each such benefit, the eligibility criteria and amounts which may received are summarized.

The information presented is only of a general nature, may omit many details and special rules, is current only as of its published date, and accordingly cannot be regarded as legal or tax advice. Please contact our office for more information on this subject and how it pertains to your specific tax or financial situation.