While it’s true that the best year-end tax planning starts on January 1 of the tax year, the reality is that most Canadians don’t turn their attention to their tax situation for 2024 until the spring of 2025, when the deadline for filing a tax return for 2024 approaches. And while that means that there is plenty of time to get the return prepared and filed, it also means that the most significant opportunities to reduce or minimize the tax bill for 2024 are no longer available. Almost all such tax-planning or saving strategies, in order to be effective for 2024, must have been implemented by the end of that calendar year.

featured Archives - Page 4 of 12 - Akler Browning LLP

While the tax return form that Canadians prepare and file each spring might look identical to the form that was used the previous year, the reality is that our tax system is constantly changing, and that change is reflected in amendments made to each year’s tax return form, which in turn affect the tax situation of every Canadian taxpayer.

Each spring, Canadian individual taxpayers must turn their attention to the filing of an individual income tax return for the tax year which ended on the previous December 31. And, while it’s doubtful that many of them do so with any degree of enthusiasm, the rate of compliance with the requirement to file a tax return in Canada is in fact very high. Last year, more than 33 million individual income tax returns (for the 2023 tax year) were filed with the Canada Revenue Agency.

The Canadian tax system casts a very wide net, in which each resident of Canada is taxable on all sources of income worldwide, with very few exceptions. In addition, Canada has what is known as a “self-assessing” system, in which Canadian residents voluntarily file an annual tax return on which they report all income earned during the previous year, claim any available deductions and credits, and pay any resulting amount of tax owing.

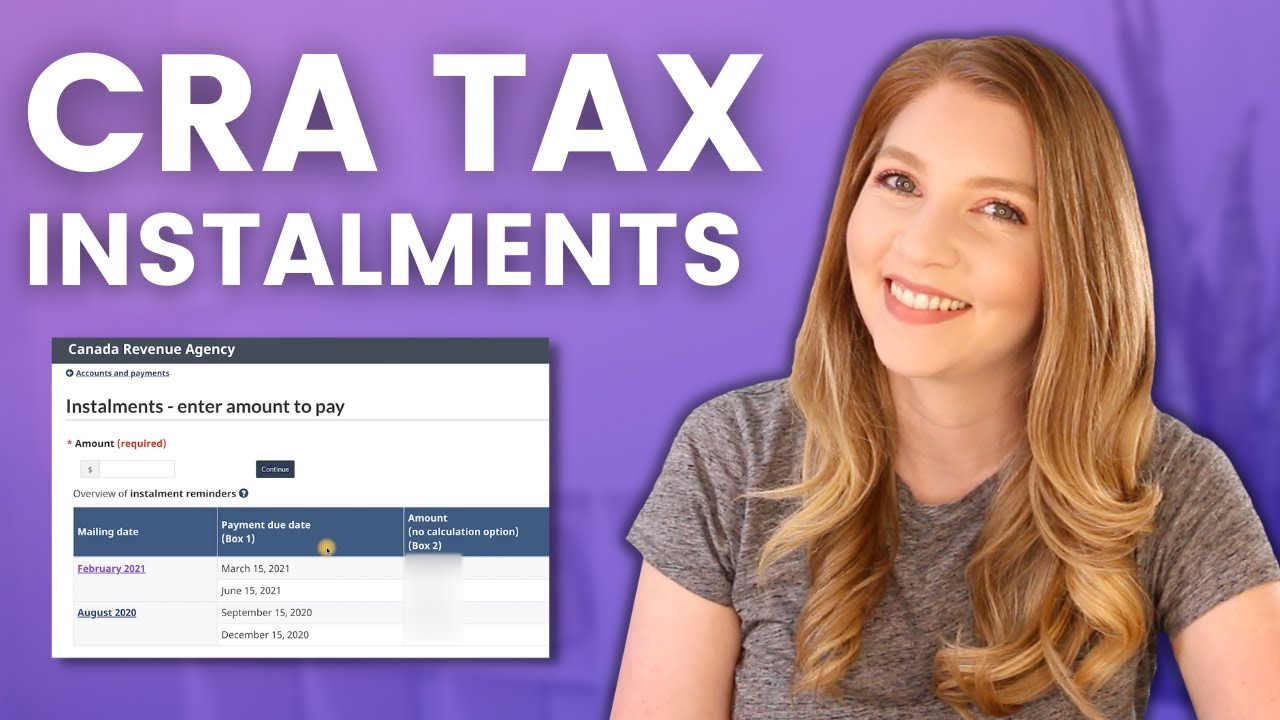

While virtually every working Canadian pays income taxes, the process by which those taxes are collected throughout the year is largely invisible to the taxpayer. That’s certainly the case for employees, because income taxes (and other statutory deductions like Canada Pension Plan contributions and Employment Insurance premiums) are, as required by law, deducted by the employer from every dollar of salary or wages paid, and remitted to the federal government on the employee’s behalf. The net amount remaining after such deductions is then paid to the taxpayer. Tax amounts withheld and remitted in this way are recorded on the employee’s T4 slip for the year, and credit for the total of tax amounts paid through such payroll deductions throughout the year is then claimed by the employee on their annual return.

For most Canadian retirees, careful financial management is a necessity. Most live on an annual income which is less than that which they enjoyed during their working years, and opportunities to increase that income in any significant way are limited. As well, in recent years, inflation (especially with respect to food and shelter costs) has meant that more and more of that income must be allocated to necessities.

The Employment Insurance premium rate for 2025 is set at 1.64%.

As of 2024, there are two contribution levels for the Québec Pension Plan (QPP). Income amounts and employee contribution percentages for 2025 for each contribution level are as follows.

As of 2024, there are two contribution levels for the Canada Pension Plan (CPP). Income amounts and employee contribution percentages for 2025 for each contribution level are as follows.

The indexing factor for federal tax credits and brackets for 2025 is 2.7%. The following federal tax rates and brackets will be in effect for individuals for the 2025 tax year.