Tax-free savings accounts (TFSAs) have been a part of the Canadian tax system since 2009, and the TFSA program can be utilized by more Canadians than any other tax-advantaged savings program. And Canadians have clearly recognized the benefits: Canada Revenue Agency statistics show that, as of 2022, nearly 18 million Canadians had opened a TFSA.

featured Archives - Page 2 of 12 - Akler Browning LLP

By the time the end of summer approaches, the tax return filing deadline for all Canadian individual taxpayers has passed, and nearly all tax filers will have filed the required return for the 2024 tax year and received a Notice of Assessment from the Canada Revenue Agency (CRA) with respect to that return. It can, therefore, be extremely unsettling for taxpayers to receive unexpected correspondence from the CRA at this time of year, especially where the Agency is requesting additional information about claims made on the tax return for 2024, despite that return already having been filed and processed. When that happens, the recipients of such correspondence often assume the worst – that they are being or are about to be audited, and that the prospect of a large tax bill, along with penalties and interest charges (or worse), looms.

The Canadian tax system provides a number of opportunities for taxpayers to save on a tax-assisted basis. Most Canadians are familiar with registered retirement savings plans (RRSPs) and many are also aware of the availability of the tax-free savings account (TFSA). The newest (and probably least well known) such tax-assisted savings opportunity is the first home savings account (FHSA), which was introduced by the federal government in the 2023-24 budget and first became available in 2023.

Over the past few decades the Canada Revenue Agency, like many other organizations and businesses, has gradually shifted to providing more and more of its services online, through its website. The Agency has been remarkably successful in bringing the Canadian taxpayer along with those efforts to the point where the vast majority (93%) of all individual income tax returns are now filed by electronic means, through the CRA website.

According to numbers released by Statistics Canada there were, as of July 1, 2024, an estimated 2.5 million Canadians aged 65 to 69 and around 2 million Canadians who were between the ages of 70 and 74. That being the case, it’s likely that during the 2025 calendar year, hundreds of thousands of Canadians will reach the age of 71 and, for retirement income planning purposes, that is a very consequential birthday.

By the time summer arrives, Canadian taxpayers have filed their income tax returns for the previous year, have received a Notice of Assessment from the tax authorities with respect to that return, and have either saved or spent their tax refund or, less happily, have paid any balance of tax owing.

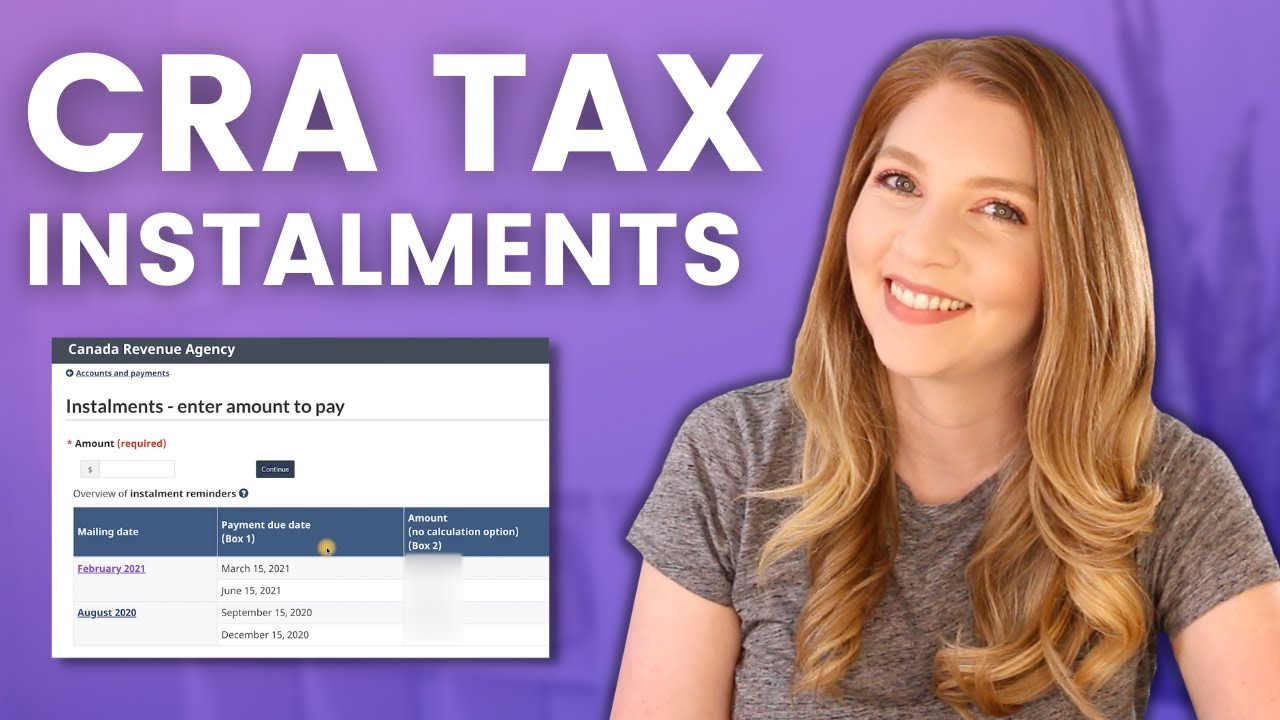

While most Canadians are familiar with the obligation to file an annual tax return and to pay income taxes owed by the end of April each year, there are in fact many more tax filing and payment deadlines imposed on individuals or businesses throughout the calendar year. Fortunately, the rate of compliance with those requirements is high, as most Canadian taxpayers meet their tax obligations, consistently filing returns and making any required payments on a timely basis. Where such tax filing or payment obligations aren’t met, however, the Canada Revenue Agency has the authority to impose both penalties and interest charges.

The work-from-home arrangements which were ubiquitous throughout the pandemic and, to a lesser degree, for a couple of years afterwards, are now largely a thing of the past for most Canadians. One of the consequences of the return to the office was the need for parents who work outside the home to arrange for (and pay for) child care – sometimes for the after-school period and sometimes for the entire day.

As of the end of May 2025, there were just under 202,000 properties listed for sale on the Canadian Real Estate Association’s Multiple Listing Service. While each of those properties and each property sale is different, all of them involve a move to a new location – sometimes a move up to a bigger and better property in the same town or city, sometimes a downsizing move, and sometimes a move to a new city or even another province. As well, earlier this year thousands of university and college students made the annual trek from their university or college residences or apartments to move back to the family home for the summer.

While it’s unlikely that they do so with any great degree of enthusiasm, the vast majority of Canadians prepare their annual tax return each spring and file that return on time. That’s necessary, because the Canadian tax system is a “self-assessing” one, in which the onus is completely on the taxpayer to ensure that a return in prescribed form is completed and provided to the tax authorities. On that return, the taxpayer provides a listing of income earned during the previous calendar year as well as any claims made for tax deductions and credits. The end result of that process is a determination of the amount of tax owed for the year; any such amount must then, of course, be paid on or before April 30.